There are 1,000 ways to cheat the government, but the government has 1001 formulas to figure it out.

Sooner or later most of us in business are going to get the call for an audit.

That is just the way it is.

It feels like an invasion of privacy having someone scrutinize your financials and it is most certainly frustrating that you have to break from your daily business to comply with this request. However, what I have seen more of over the years are the sleepless nights leading up to the audit wondering if you are going to owe money at the end?

Here are 4 ways to receive a negative result in an audit; The most common cause for not passing an audit is when a business owner claims 100% of their business expenses, but not 100% of their revenues.

This one is too easy to formulate that something is not right with the financials and cash under the table is in the equation.

The second most common cause for not passing an audit is when a business owner claims personal expenses as business expenses.

In an audit you must prove that all claimed expenses had something to do with the business. Trips, meals, gas and office expenses are commonly reviewed by an auditor. Cell phones and auto insurance with the entire family on the plan doesn’t go over well either.

The onus is on you to prove business expenses. It is advised to (as it is often overlooked): Keep all receipts (business and personal – separated of course) Keep a log of all business-related mileage

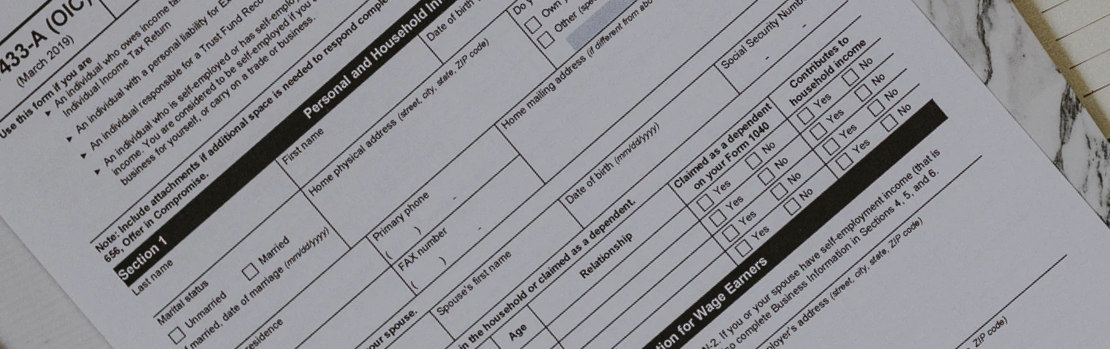

The third most common cause for the government showing up for an audit is not keeping up with your “Trust” obligations. Payroll deductions, HST, WSIB, EHT, Corporate taxes should be filed and paid in full by the due date. Once you go down the path of getting behind, the red flag eventually gets raised and then it is just a matter of time when the audit letter arrives.

The fourth most common cause for not passing an audit is over claiming HST paid on expenses. This one has to do with your data entry. Whom ever is doing your bookkeeping, it is very important they know the HST rules? Knowing which purchases are exempt and which province or country the expenses were purchased, plays a key role in accuracy to the data entry.

There are many other ways for your business to be called for an audit. Should we worry that Revenue Canada is always looking over our shoulders? I don’t believe so. That is not time well spent.

I simply do my best to keep my own books clean and move on with growing my business and having fun with my clients.

If I get the letter, it is what it is.

Thanks,

Sandi Holst

Bruce Peninsula Business Alliance Inc.

Phone: 519-719-4654